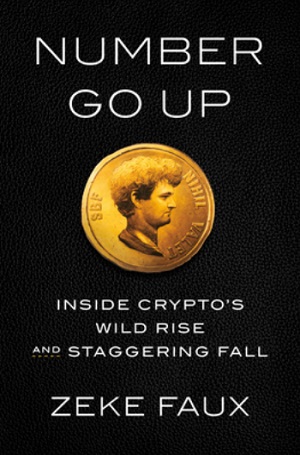

Number Go Up: Inside Crypto’s Wild Rise and Staggering Fall

By Zeke Faux

The crime:

In 2022 the cryptocurrency exchange FTX (short for “Futures Exchange”) went bankrupt, after having hit a peak valuation of $32 billion just weeks earlier. The founder and CEO Sam Bankman-Fried (popularly designated SBF) was later convicted of fraud, conspiracy, and money laundering.

The FTX story is only the best known part of the crypto chronicle Zeke Faux tells here. There’s a funny image of an SBF coin on the cover with the latin tag “Nihil Valet” (No Value), but this is really a more general look at, as the subtitle has it, the rise and fall of cryptocurrency. In fact, the main target of Faux’s suspicions throughout is the “stablecoin” Tether, which turns into a kind of crypto white whale that he never lands. Nevertheless, Money Go Up is a great read: tart, funny, and filled with telling anecdotes from a journalist who circled the globe, apparently several times, to get the story. I burned through it in a day.

It’s not the whole story of crypto, or, for that matter, of FTX. For example, Faux deliberately eschews going into much detail about how cryptocurrencies works. This is something I can’t fault him for though, as I’ve consumed a number of explainers on the subject and come away with only the fuzziest notion of how the system operates. In my personal experience, however, I’ve found I know more than most people who’ve dabbled in cryptocurrency (including many obnoxious true believers mixed in with the merely crypto-curious), and there are several times in Faux’s narrative where he has crypto insiders admit that they don’t know much more.

Of course, being opaque has always been a feature and not a bug when it comes to crypto. As its name suggests, this is a currency whose whole point is to slam the door on transparency. And it is this character that, in turn, has made crypto the currency of choice for all kinds of criminal activity: Internet scams, tax evasion, human trafficking, and (most of all) money laundering. As a lawyer I knew told me back when this stuff just started taking off: there’s a reason why they want to keep it secret. And as I wrote here several years ago:

As with anything involving a lot of tech, a lot of money, and a lot of secrecy, I am suspicious of all of this. “Cutting out the middleman” and facilitating faster financial transactions may be of some value, but they don’t seem like really pressing needs for anyone. Meanwhile, avoiding any oversight is the kind of thing mostly bad actors want to take advantage of.

What’s the point of crypto anyway? As Faux entertainingly makes clear, it is not a convenience. The middlemen aren’t cut out, and indeed they take an even bigger piece of the crypto action than the much-despised banks do with regular (fiat) currency. When, strictly for journalistic purposes, Faux purchases and then sells a mutant ape NFT he names Doctor Scum the process is described as “excruciating” and confusing (the NFT is actually sold hours before he knows about it, which he accounts “some of the worst hours of my life”). Then there are the extra costs involved (and keep in mind this was only a $20,000 sale):

Had I been trading in U.S. dollars, I would have lost about $800. But in crypto, there’s a fee associated with every transaction. I ended up wasting at least another $1,160: $36 to Coinbase, $497 to Yuga Labs for their 2.5 percent cut on all ape sales, another $497 to the NFT marketplace, $90 to Bank of America, and about $40 in Ethereum fees.

Convenience? Getting rid of the middle man? Lower fees and transaction costs? Not likely. When Faux travels around the world trying to use crypto, even in states where its use is encouraged by the government, all it leaves him with is

a new appreciation for my Visa card. It worked instantly, with just a tap, charged no fees, and never asked me to memorize long strings of numbers, or to bury codes in my backyard. It even gave me airline miles. When my wife’s account was hacked and used to book an Airbnb, we were given a full refund with just a phone call.

Say what you want about the inconvenience of dealing with your bank, and I could say a lot, when it comes to customer service for your cryptocash account the bottom line, as relayed by one artist profiled here, is “SORRY YOU’RE FUCKED.”

The inconvenience of actually using crypto for anything leads to some funny stories, but they underline that question I asked earlier: What’s the point of crypto? Some of its popularity seems to be driven by the kind of thing that in politics is referred to as negative or affective polarization. A good example of this comes when Faux attends a crypto conference in the Bahamas (a “giant volcano of crypto bullshit”) where SBF was interviewed on stage by business author Michael Lewis. Now at the time Lewis was writing a book on Bankman-Fried (Going Infinite), which is always a bad sign. A very bad sign. Faux describes him as “lavishing praise” on big tech’s latest wunderkind, and asking questions “so fawning, they seemed inappropriate for a journalist.” But aside from that, it’s interesting to note some other things.

Lewis said he knew next to nothing about cryptocurrency. But he seemed quite confident that it was great. The writer said that, contrary to popular opinion, crypto was not well suited for crime. He posited that U.S. regulators were hostile to the industry because they’d been brainwashed or bought off by established Wall Street banks. I wondered if he simply hadn’t heard about the countless crypto scams, but the thought seemed preposterous.

“You look at the existing financial system, then you look at what’s been built outside the existing financial system by crypto, and the crypto version is better,” Lewis said.

Better? In what way? Michael Lewis is no dummy. So why, aside from the fact that he was being given access to SBF in order to write his book, was he so deep in the tank for crypto? One part of it, I think, is that negative polarization I mentioned. Crypto is obviously shady, but the government, the “established Wall Street banks,” “the existing financial system” and the elites running it, they are the enemy that needs to be destroyed. The hate, amplified by media and social media, becomes such a powerful drug that even successful elites become willing to cut off their nose to spite their face.

Another draw for crypto is that it is, effectively, a form of gambling, with supposed insiders and people who know the system making piles of money off of the suckers. At several points Faux even likens the crypto exchanges as being a casino. Meanwhile, time and again he tries to think of some real world use for cryptocurrency and comes up with nothing, aside from (obviously) enabling and concealing criminal activity. And, I suppose, letting rich kids play at being crypto bros, happy to give their money to bored billionaires rather than having to do anything so déclassé as paying taxes. Bored billionaires who, in turn, don’t give a damn about consumer protections or safeguards and are just squirreling their money away in offshore boltholes while running schemes many of them openly acknowledge to be fraudulent. One crypto executive thought his job title should be “Ponzi Consultant.” Another “happily” described his business as a “never-ending Ponzi scheme . . . what I call Ponzinomics.”

One thing that struck me is how brief a run FTX enjoyed. The exchange was only founded in 2019, took just a couple of years to reach stratospheric valuations, and was then kaput by 2022. The rise and fall of crypto (and at this point we can only pray that crypto won’t make a comeback, at least to the kind of hysterical levels described here) didn’t take very long. J. P. Morgan CEO Jamie Dimon compared it to a pet rock, and I don’t think NFTs lasted any longer than that iconic fad from from the 1970s. Do we even remember the bored ape NFTs anymore? Or Razzlekhan, the self-styled rapper who was one half of the biggest heist in history? If not, at least we won’t have to explain them to future generations.

That said, crypto is still with us, and all the terrible shit that comes with it. As Annie Lowrey recently reported in The Atlantic:

The FBI reports that cyper-investment scams cost Americans $4.6 billion in 2023 [remember: FTX collapsed in 2022], up 38 percent from the year before, and 1,700 percent over the previous five years. That’s more than ransomware scams, fake tech-support swindles, web extortion schemes, phishing attacks, malware breaches, and nonpayment and nondelivery frauds combined. And it is an undercount, given that it includes only complaints made to law enforcement; most folks don’t bother making a police report in an attempt to get their bitcoin back, knowing it is hopeless.

So why does crypto persist? Because people, greedy people looking to make a very quick and very easy million, or billion, want to believe in it. It’s basically a cult, and Faux isn’t under any illusions that it will be going away anytime soon.

I didn’t think the prices of all of the cryptocurrencies were about to go to zero, or that we’d never see another hot new coin mint overnight billionaires. On the stock market, pump-and-dump scams have persisted for hundreds of years, and yet there are still new suckers willing to buy shares in some shell company that claims to have struck gold.

The one coin I especially wouldn’t bet against is Bitcoin. It’s not that it’s useful – if anything, it’s more unwieldy than the others. But Bitcoin’s true believers are so convinced that it’s hard to imagine anything will change their minds. To them, whatever the question, the answer is “buy Bitcoin.” Everything they see is evidence Bitcoin will rise, like the members of a cult certain that the apocalypse – and their salvation – is just around the corner.

What surprised me, after finishing Number Go Up, was how little I ended up caring about SBF. Perhaps it’s just because that, while a crook, he was far from the worst crook in an industry rife with scammers. But I also couldn’t help feeling that he didn’t care all that much either way about the money. To be sure, he was no altruist, effective or any other kind. But the impression I had was that he knew all along FTX was a joke, a funhouse ride filled with smoke and mirrors, and he was just waiting for the inevitable collapse in his 12,000-square-foot Bahamian penthouse, eating junk food and playing videogames until the Feds came calling. Faux registers surprise at how blasé he appeared when the whole house of cards came crashing down, which for some reason made me think of the response the chief weapons investigator had when he informed George W. Bush that Iraq didn’t have any weapons of mass destruction. He was struck by how uninterested the president seemed. Did he believe they did? Or did he just not care? That’s the thing about bullshit, as defined by Harry Frankfurt. It’s not a lie if you don’t care if it’s true or not. I think SBF was living in an entire ecosystem of bullshit, unconcerned over whether any of it was real.

This is part of what makes Number Go Up such an entertaining and even downright funny a book. But that would be the wrong takeaway. Yes, there are plenty of freaks and geeks to amuse us, like the “laughably weird founders” of Tether. The crypto world is one, Faux tells us, “where a lack of experience or competence has never been a barrier to fame and fortune.” So much for the meritocracy! But dig a little deeper, as Faux does, and you see beyond the great fortunes to the destroyed lives and violent crimes that are such a big part of the crypto story. The book gets progressively darker, finally taking us to a slave-labour cyber-scam camp in Cambodia. It’s a horrifying vision of a world we rarely get to see, and the worst part of it is that it’s probably not even the smallest or most evil part of what’s really going on.

Noted in passing:

What does money buy?

Alex Mashinsky was co-founder and CEO of the crypto lending network Celsius, a company whose business model never seemed to make the slightest bit of sense. When we last see Mashinsky it’s in a Manhattan courtroom, as part of a hearing into a dispute between Celsius and a former employee after Celsius’s bankruptcy (Mashinsky himself would later be arrested and tried for fraud). But when Faux interviewed him at a smoothie shop he was still riding high.

The interview doesn’t go well. Mashinsky blows a bunch of smoke at Faux about Celsius being a five-legged stool or a candy shop, but then gets distracted by his disintegrating paper straw which requires him to order his public relations representative to bring him another one. I’m sure it’s just me, but I would hope that if I ever get to be really rich I’ll never ask someone to fetch me a straw. I’ll get my own.

Things get worse though when Mashinsky gets annoyed at the noise of the smoothie shop’s blender (something I would have thought very much part of the atmosphere in such a joint). “Can we get out of here? It’s just driving me crazy!” he yells. Retreating to his $8.7 million apartment the interview continues as picks “at a tray of fruit brought by another assistant.”

Why do people want to be rich? For some of them it’s just so they can be like this.

Takeaways:

You don’t really invest in cryptocurrency. Investment means buying shares in a company which then does things in a real economy, like employ people and make things. At best, cryptocurrency is a form of gambling. As Faux concludes, the promises made about crypto have proven empty, while “the benefits of crypto to the rest of the world seemed to be limited to enabling a zero-sum gambling mania.” And gambling is always odious and profoundly damaging to society and individuals.

And, just to repeat: it’s only gambling at best. It can be a lot of other things that are worse.

Never been able to get my head around crypto, don’t think I ever will, but that’s ok I’m happy with pounds and pennies.

LikeLiked by 1 person

Also I dunno how I did it but I think I’ve blocked you from my site and I can’t find a way to unblock you. Try commenting on my blog see if you still can?

LikeLiked by 1 person

OK.

LikeLiked by 1 person

Advice I got a long time ago is don’t put money in something you don’t understand. So I’ve stayed far away. I think over 90 percent of the people buying crypto don’t have a clue how it actually works.

LikeLiked by 1 person

The harder that crypto cult converts try to convert the rest of us indicates the basic shonkiness of the whole enterprise. In gambling, the house always wins, and crypto needs a whole bunch of yokels with straw between their teeth and a pig under one arm. I dodn’t intend to be one, but I enjoy laughing at anyone mug enough to get involved.

LikeLike

I can laugh at the crypto bros, who have the money to lose for sure. Problem is a lot of vulnerable people are getting destroyed by this stuff and it’s being used for some really dark purposes, with no public benefit.

LikeLike

I think Crypto is here to stay. I think it has a lot of changes to go through, but at some point it will be as easy to use as a credit card.

Maybe.

I hope I am not alive at the point because that will be when cash is truly dead 😦

LikeLike

Yeah, I’ve been thinking more and more about how much I’m not going to miss when I’m gone.

LikeLiked by 1 person